Every year, large retailers and Fortune 1000 companies across industries such as manufacturing, energy, healthcare, and consumer goods execute thousands of indirect spend contracts for goods and services with complex terms and conditions that often go unchecked—and represent millions of dollars in overpayments. Confirming compliance with contract terms is critical to ensure what was negotiated was received, but identifying errors is just the first step on the path to complete payment accuracy. Supplier cooperation is critical, but not always easy to obtain. A skilled audit partner with a vast network of supplier relationships can best navigate the negotiation and settlement process to drive a fair and favorable outcome for all involved.

Cotiviti’s experienced Contract Compliance audit team completes more than 100 audits per year for our clients, deploying dedicated experts to review the terms, conditions, and intent of suppliers’ contracts and compare them with goods and services actually delivered. We identify anomalies to contract intent thorough analysis of key cost, pricing, and profit elements within each contract. The risk profile we have developed can help identify potential audit opportunities.

Benefits

Our audits dive deeply into contract foundations, identifying compliance shortfalls, surfacing corresponding payment errors, highlighting contract issues, and identifying risk. We accomplish this by analyzing the source of key cost, pricing, and profit elements and supporting payment documentation. Equally important, we protect and maintain critical business relationships and make insightful and accurate process improvement recommendations that mitigate future financial losses.

Our contract-related work spans virtually all categories of our clients’ spend, delivering current and future savings that can total millions of dollars. From labor to logistics to IT to recycling, we assist our clients across their diverse contract universe to spot noncompliance in their highest-risk vendor relationships. We routinely review contract structures, such as cost-plus, unit cost/price, time/expense, and lump-sum agreements. And we scrutinize complex terms and conditions, such as gain sharing, labor-rate build-up, index-based pricing, overhead mark-ups, rebates, and more.

The breadth of experience within our Contract Compliance audit practice spans a wide array of contract types, spend categories, contractual elements, and service categories. Our audits are comprehensive and can address both direct and indirect spend. Our experience and expertise extends into many areas. Our clients appreciate the sensitive approach we take in providing meaningful savings opportunities and insights to strengthen future agreements.

We not only review our clients’ data but also travel to the supplier’s site, when appropriate, to review their records, such as invoice and cost source data. Compliance can be accurately calculated only by testing this source data.

Non-merchandise spend categories that we review include:

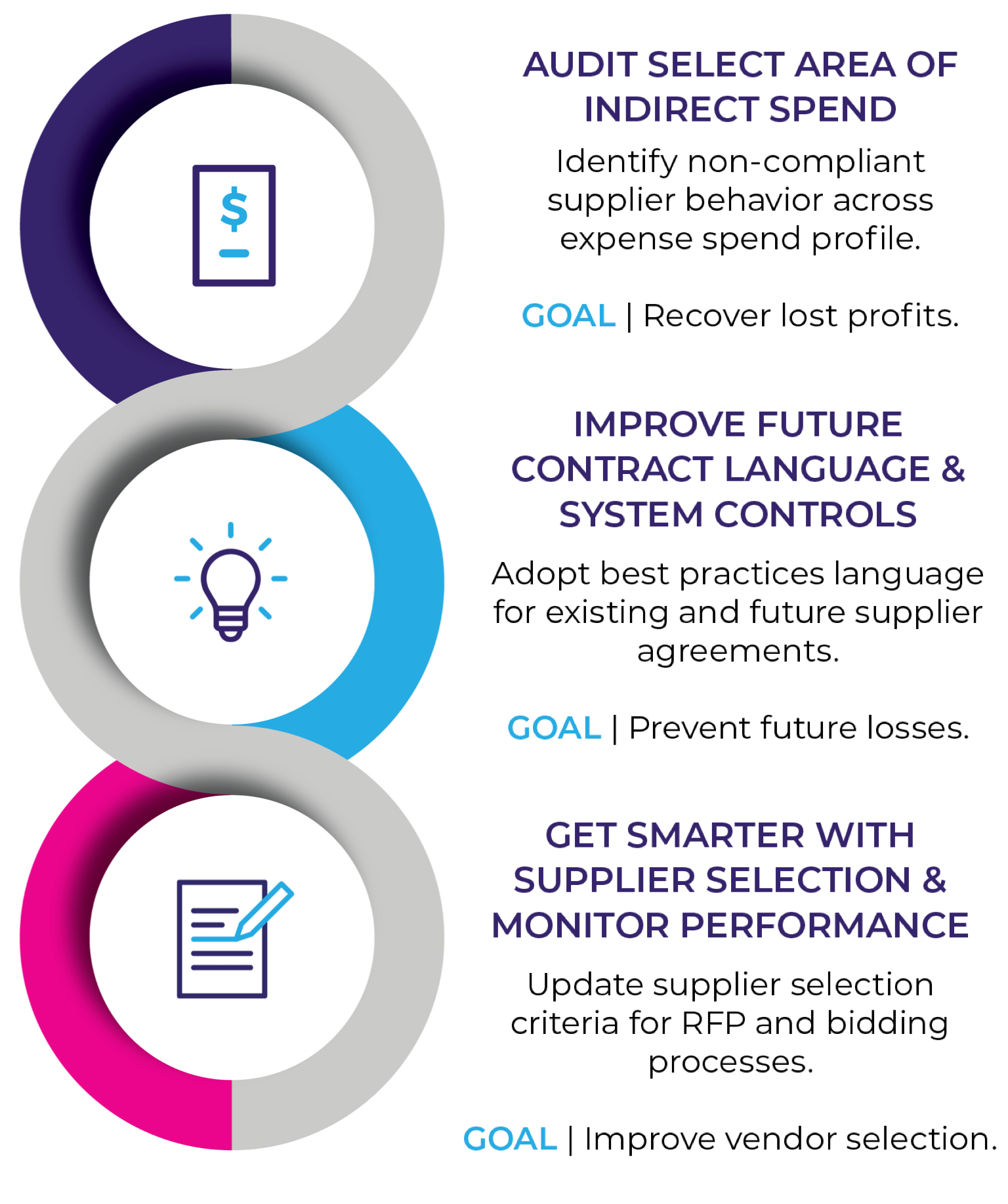

Following the Cotiviti pillar of continuous improvement in audit programs, our experienced team understands that each contract compliance project yields insights that can drive future cost savings. We work to understand the root cause of errors, overbillings and efficiencies. From there, we recommend processes and control procedures to avoid recurrence. Finally, we help our clients’ Sourcing and Procurement teams develop better supplier selection criteria. Rather than approach a Contract Compliance audit as a “one off” project, Cotiviti helps its clients build a program that matures over time and has a transformative effect on supplier sourcing.

.png)

Selecting categories of indirect spending on goods and services to audit is not a “one size fits all” exercise. Often, an area of interest for one client is not advisable for another. At the outset of an audit program, Cotiviti works with clients to identify the “best fit” for contract compliance work. One consideration is transparency – if a client has a solid line of sight into a supplier relationship, they’re less likely to be at risk for overcharges. Many of our largest findings originate where individual instances of overcharges draw the attention of a category spend manager. Locate an area where a few invoices were wrong and a deeper dive, with more time and dedicated resources, is likely to uncover a recurring issue.

When Cotiviti identifies overcharges and cost inefficiencies, we work with our clients to improve contract language to clearly state in an “ironclad” manner that these non-compliant practices are not allowed going forward. We also assess whether the proper system controls are in place, e.g., a system that automatically verifies whether a supplier is billing at the agreed upon price.

Ambiguity in contract language opens the door for non-compliant supplier behavior. The same goes for imprecise KPI metrics that suppliers view as loopholes to cut corners in an agreement. Improving clarity where ambiguity exists and defining clear performance metrics are just two examples of how strategic sourcing and procurement teams can guard against future losses.

One of Cotiviti’s key strengths in auditing Goods not for Resale (GNFR) is our vast network of supplier and vendor relationships. We continue to cultivate a growing list of vendors to participate in the Contract Compliance audit program. As a result of completing over 1,500 contract compliance audits, Cotiviti has developed a risk matrix and key criteria for selecting potential supplier audit candidates, including:

A large US retailer suspected billing issues for its information technology (IT) staffing agreements. The retailer was utilizing both domestic and offshore resources contracted at different rates. Data access and integrity were chief among the concerns as Cotivit’s auditors worked with the supplier to review compliance. During our investigation, we obtained facility access records to dispute the hours reported by the supplier. We also conducted an offshore site visit to interview management and observe processes tied to the number of hours being billed. Our experienced team found that billing both exceeded daily maximums and was at a rate higher than contractually allowed.

Identified >$8.2M in overbilled hours, rates, and fees

Achieved >$2.5M in estimated future savings by improving supplier billing processes, document retention, and controls

Recycling services result in net remittances due based on negotiated rates and the weight of materials collected. Vendors are responsible for self-reporting every load with related weights by material type. Cotiviti reviewed and analyzed nearly 450,000 individual loads and transactions on behalf of a large global retailer. Our model of expected volumes when compared against reported recycling revealed evidence of serious under reporting, a 3rd party scam, and unethical practices.

>$1.5M in underpaid remittances identified, mainly from unreported loads

Re-defined process for weighing, tracking and reporting bales and the use of S/N tags for ID

A Fortune 1000 company with personnel and facilities scattered across the U.S. suspected inaccurate billings by a freight and warehousing services vendor. Cotiviti’s contract audit revealed an unethical practice of switching between fixed-fee and cost-plus pricing only when the outcome was favorable to the supplier. The supplier was also using a 3rd party to support overbillings related to fuel prices.

Identified >$9.5M in overbilled freight, services, and fuel

Provided detail recommendations for updating and reviewing freight billing practices

The procurement team for a large U.S. retailer signed two different types of agreements for repair and maintenance services – one was a time & materials agreement that required time validation. Cotiviti’s investigation showed that the supplier was “manufacturing invoices” by billing a lump sum and subsequently invented time & material costs to bill the client. The vendor invoices showed inflated hours and material costs tied to a sub-contractor.

Additional services provided under a maintenance contract were expected to prevent repairs. Our audit found that ~20% of the repair work performed was preventable if the routine maintenance service had been performed appropriately.

>$3.5M identified in overbillings

Identified service issues where preventive maintenance did not eliminate need for repairs