The retail industry continues to evolve as traditional big box stores, pioneers in eCommerce and digital first disruptors pursue omnichannel and multi-channel strategies to reach consumers. If anything, relationships with suppliers and vendors, as well as the web of contracts, service agreements, purchase and promotional allowances, and pricing across these channels, is growing even more complex.

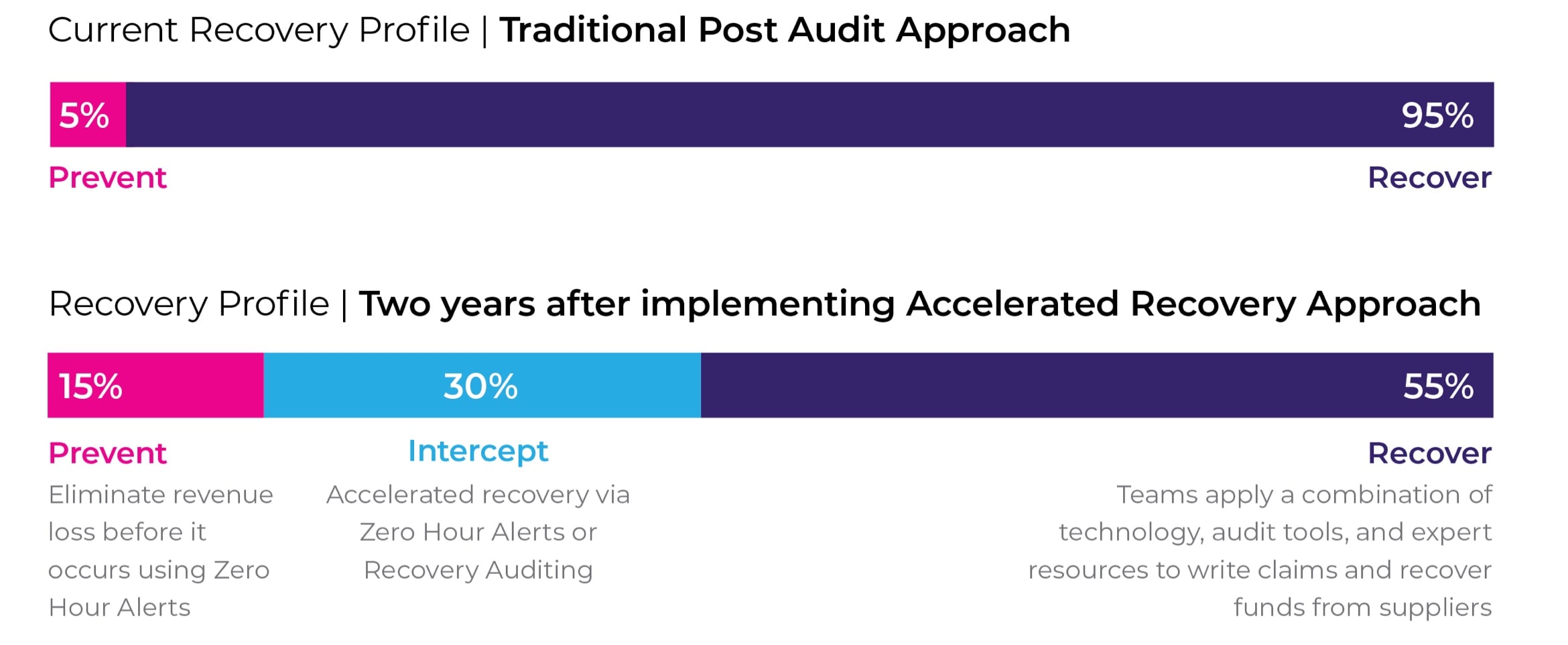

Each disparate data point has the potential to impact profit today and well into tomorrow. Maximizing recoveries to make up for lost margin is only one part of the equation. Shifting recoveries further upstream, closer to the transaction date, is the fastest path to value. This shift from traditional post audit to a more accelerated approach requires a partner with flexible solutions that align to your organization's needs as well as deep domain knowledge down to the individual claim level.

The goal of any traditional Goods for resale (GFR) recovery audit is to maximize the amount of revenue leakage identified and added back to a retailer’s bottom line while balancing critical supplier relationships. All recoveries, however, are not created equal. A dollar recovered within 60-90 days of the original transaction date is much more valuable than a dollar recovered 18 months from the transaction date – if those funds can be recovered at all.

Taking an approach that accounts for the complexity of accelerating an audit, Cotiviti works with clients to identify the claim categories and individual claim types that can have the most significant impact on cash flow. Once the program opportunity is clear and all key stakeholders are aligned, we set out to accelerate an audit by focusing on expedited data acquisition, process improvement, root cause insights, and the empowerment of internal audit teams to operate proactively. Collaborating on continuous improvement drives acceleration of recoveries and can have an immediate impact on margin accuracy. Over a two-year span, the cumulative buildup of acceleration opportunities has the potential to dramatically alter a client’s recovery profile.

Identify and act on problematic transactions shortly after payment

Once a supplier creates an invoice that contains a pricing or funding error and that invoice is paid, the recovery countdown begins. Many transactions and claim types meet the criteria for interception – accelerated recovery that takes place within 6 months of the transaction date, and ideally within the fiscal period. Cotiviti can apply proprietary Zero Hour Alerts in combination with recovery auditing during this time period. Our approach aims to shorten the path to value, reduce supplier friction, and ease the finance backlog associated with a lengthy claim resolution process.

Setting the standard for accuracy and performance

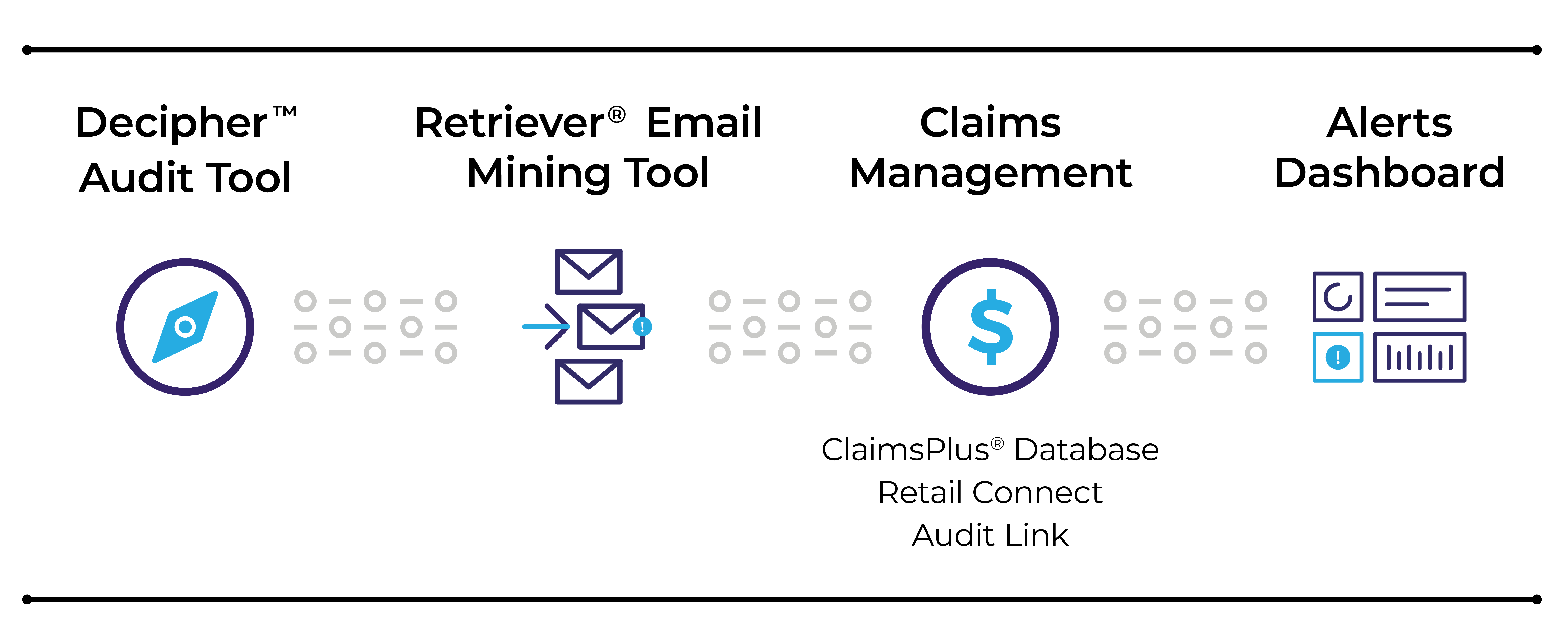

A comprehensive recovery audit digs deep into transactional data to unlock hidden value and find financial leakage across a retailer’s vast supplier network. Cotiviti relies on a combination of technology, experienced auditors, and deep domain expertise to accelerate error resolution and increase the value of recoveries for our clients by shifting them closer to the transaction. Our teams deliver a high level of accuracy (low payback rate) and performance (high catch rate) for the largest retailers in North America. We offer conventional recovery auditing as a primary or secondary pass, a Cotiviti-hosted audit platform to support internal teams, and outsourcing support. Finally, we are breaking new ground with an Integrated Audit that brings internal and primary teams together to eliminate artificial barriers to acceleration.

As part of any traditional post-audit recovery program, Cotiviti performs claims management and delivers root cause insights and recommendations that clients can carry forward to fix recurring issues and improve internal processes. Continuous improvement is a main tenant of a Cotiviti recovery audit and our clients realize the benefits of this process as our team becomes increasingly knowledgeable over the lifetime of an audit program. Our recovery audit services include the following:

Every audit program is unique and the approach a retailer takes can vary significantly. Cotiviti’s goal is to meet our clients in the right place to positively impact the outcome of an audit. Our teams start with deep domain experience across three defined business segments and then apply resources, services and technology in a way that best aligns to the attack strategy of a client. While one retailer is focused on improving the performance (catch rate) of internal teams and empowering those teams through the use of our Cotiviti-hosted audit platform, another may opt for full outsourcing solutions.

Delivering the highest degree of performance and accuracy

A Primary Audit is the first pass that follows work completed by a retailer’s internal team. Retailers set high expectations for a primary audit provider. The first pass is expected to deliver both a high catch rate and a high degree of claim quality. Organizing an audit in a manner that accelerates the resolution of claims is also a top priority for the first pass audit firm. Clients lean on Cotiviti’s deep expertise to provide meaningful process improvement recommendations derived from root cause insights. We focus on the hallmarks of a successful primary audit – the highest degree of accuracy (claim quality), a strong continuous improvement process, and collaboration to accelerate claims.

Cotiviti is currently in the primary audit position for 16 of the largest retailers in North America. More than half of our primary positions can be attributed to promotions due to larger than expected findings in a secondary role. Not only has Cotiviti been promoted from secondary pass to primary audit in a majority of situations, we’ve held that position by consistently exceeding delivery expectations.

Leveraging experience to tackle the most complex recoveries

A Secondary Audit pass is typically third in line to review data and write claims – an internal team and primary firm would have already reviewed the data and identified sources of margin loss. However, a secondary audit firm does continue to find meaningful recoveries. The number of leftover recovery opportunities still uncaptured demonstrates the complexity associated with digging deep into a retailer’s business to uncover revenue leakage. Recoveries found in a secondary pass are the most complex and difficult to find. An extra degree of difficulty is added to collecting on these claims as a significant amount of time has passed since the transaction date.

Success in a secondary audit pass requires a deep understanding of client, industry, and data. In a secondary audit, experience matters most. Identifying gaps in both a retailer’s internal and the primary audit requires highly skilled auditors and embedded engineering support to create customized tools. Cotiviti has the most experienced auditors and engineers in the industry working side-by-side to uncover the most complicated errors. Cotiviti began performing secondary audits 40 years ago and has a long track record of exceeding performance expectations. Excellence in secondary auditing has often led to primary promotion and enduring relationships with our clients.

Customizing audit tools to improve internal team performance

For many years, Cotiviti excelled in the delivery of accurate and high performing audit solutions to its Retail clients in a primary or secondary role. Software to support a retailer’s internal teams was the domain of less experienced firms with fewer resources, a limited ability to customize audit tools, and a lack of deep expertise dedicated to exploring new and adjacent opportunities. The shortcomings of competing software tools can be measured by the significant recoveries found behind those internal audit teams.

Cotiviti is now committed to solving the challenge inadequate software tools have posed to the effectiveness of internal audit teams. Over the past year, our engineers have collaborated with clients to develop a solution that would provide the customization needed to capture the lion’s share of claims. Our hosted audit platform allows for the deep collaboration necessary to maximize the effectiveness of audit tools within tight audit timelines.

Eliminating the artificial barriers between internal and primary audits

Today, most retail organizations operate within the confines of conventional audit formats – internal, primary pass, and secondary pass. Typically, each of these stages are isolated with different providers servicing each area. While this approach has its benefits, there are also drawbacks to conducting an audit in this manner. The rules of engagement between an internal and a primary create artificial barriers. These artificial barriers prevent retailers from realizing the goal of acceleration and intervening to resolve issues much closer to the transaction:

Providing support as internal teams expand or reduce scope

As retail organizations evolve their approach to a recovery audit, they often choose to scale up or scale back the responsibilities and audit scope of their internal team. When retailers reduce the scope of an audit that falls on an internal team, Cotiviti’s comprehensive service offering allows us to quickly and seamlessly take control of the audit process. Our experienced teams work with clients to ensure a smooth transition.

Nearly all retailers desire to shift recoveries upstream closer to the transaction but many are not willing to tackle the complexities necessary to implement an accelerated audit solution. A large specialty retailer in the DIY category was an early adopter of acceleration and took proactive steps to increase the value of recoveries. The client made widespread use of unstructured email data and implemented Zero Hour Alerts for vendor funds. The results were impressive:

$12.5 million realized over 6 months earlier than historical timelines for previous Merchandise audits

Freight audit accelerated to a rolling 90-day review

Statement audit accelerated to a rolling 120-day review

Improving days to cash can also affect acceleration efforts. Vendors consistently indicate that audit acceleration is beneficial to their processes, especially when issues can be resolved within the fiscal year. Audit acceleration goes beyond just identifying and writing claims faster. Timely collection of claims is also important. Cotiviti worked closely with a large grocery-drugstore chain on a multi-year acceleration initiative.

Delivered a proof of concept that demonstrated advance notice of scan promotion errors

Secondary audit met or exceeded collection effort of primary firm in terms of percentage of claims collected, dollars collected, and average days to cash

The goal of a primary pass is to maximize recoveries while at the same time collaborating with internal audit teams on continuous improvement. Working in the primary position for one of the world’s largest mass merchant retailers, Cotiviti has realized stellar results – exceeding the recovery budget 8 out the last 10 years, at rates of 110-125%.

Root cause insights added significant value to several stakeholders for one of our clients including merchandising, internal audit, and pharmacy. We also recommended changes to data acquisition processes in order to expand the scope of data available to assist an audit.

Achieved a 5-year combined catch rate of 95%

Realized significant growth in Pharmacy and Grocery segments coming in at over 200% of budget

Reviewed all Pharmacy (Rx) datasets to evaluate next steps for audit acceleration

Industry-leading success metrics in terms of accuracy (approx. 2% payback rate) and performance (96% primary catch rate) have opened the door to non-traditional recovery audit areas with one Specialty client. The trust built around these results has led to collaboration on non-traditional recovery audit projects such as carrier freight claims, scans for specific suppliers, appliances and more.

And to further illustrate the value of email data mining to a successful audit, a significant amount of our findings in the non-traditional projects can be attributed to merchandising and supplier turnover.